Dental Coverage for the Self-Employed

As a self-employed individual, you want to put your money in the best investments. And nothing proves its return on investment better than dental benefits

from a company that encourages continued preventive care. That’s what Delta Dental provides: dental plans for individuals that will help you protect

your smile and your health. When you practice consistent preventive care, your healthy smile is much less likely to need complex treatments down

the line. Delta Dental benefits for self-employed individuals makes finding the right dentist in your area an easy task. Our extensive network

of dentists and the variety of self-service tools we offer help keep your dental health top of mind. So, if you haven’t already, take the time

to get to know why we offer dental plans for individuals who are self-employed.

As a self-employed worker, allocating limited resources correctly (whether that be your time or your money) helps keep things running smoothly in work and in life. We know that while you’re investing in your own success, you’re also aiming to keep costs low.

By 2020, researchers estimate 42 million Americans will be self-employed. Delta Dental understands just how important it is that we provide self-employed individuals like you with access to affordable, accessible dental care. The self-employed are not eligible for employer-provided benefits, which is why you should review our dental plans for individuals if you haven’t already.

Factor in every scenario to choose the best coverage for your lifestyle.

What’s the Value of Dental Plans for Individuals?

Stay informed about all your options for funding your health and wellness. There are other options for self-employed individuals that are just as unique as you are:

- quizzes

- challenges

- oral health educational resources

- magazines for kids

- science experiments

- videos

- fluoridated tap water

- cavity-fighter Meta Description: Optimal fluoride levels in public drinking water provide a safe

- effective and inexpensive health benefit by strengthening tooth enamel against cavities

- gift ideas

- water flossers

- teeth whitening

- educational resources

- books

- vision health

- eye makeup

- eye disease

- stye

- Dry Eye Disease

- benefit period

- preventive services

- basic services

- claim

- claim denial

- maximum

- copay

- deductible

- premium

- out-of-pocket

- OOP

- EOB

- explanation of benefits

- dental insurance terms

- sweet scale

- Holiday

- holiday challenge

- chocolates treats

- Healthy Holidays

- Healthy Holidays challenge

- trade

- cash

- Arkansas Mission of Mercy

- ArMOM

- volunteers

- dental pain

- dental clinic

- dental event

- Arkansas State Dental Association

- expanded benefit deductible

- waiting period

- waiver

- social media

- follow us

- news

- updated

- oral health tips

- dental insurance tips

- teacher resources

- parents resources

- impact stories

- driving

- eye conditions

- hazardous driving conditions

- Presbyopia

- dry-eye

- astigmatism

- bitewing X-rays

- periapical X-rays

- sensors

- dental disease detection

- infections

- covered services

- reduced risk

- RS4K

- Right Start 4 Kids

- 100% dental coverage

- 12 years

- deductibles

- co-insurance

- check-ups

- veterans

- Veterans Day

- free

- Operation Stand Down

- volunteer

- free dental care

- claim denied

- denied

- claims

- Q4

- insurance brokers

- inquiries

- quotes

- proposals

- complexities

- rules

- regulations

- staff limitations

- clients

- deadlines

- Open Enrollment

- school performance

- grades

- toothaches

- GPA

- parental support

- oral health education

- dental care

- patient satisfaction

- feedback

- dental emergencies

- sudden dental issues

- after-hour dental care

- virtual dentist

- virtual dental visits

- Strategic Initiative Grant

- media

- guest column

- op-ed

- Toothapalooza

- free admission

- dental screenings

- fluoride varnish treatments

- oral health activities

- family-friendly

- CAHPS Dental Plan Survey

- dental experiences

- dentist satisfaction

- dog dental care

- dog teeth cleaning

- pet’s teeth

- pet insurance

- anesthesia

- scaling

- polishing

- vet

- veterinarian

- summertime

- summer break

- ice cream

- sugary treats

- routines

- kids activities

- 2023 State of America’s Oral Health and Wellness Report

- survey

- survey results

- generational knowledge gaps

- Boomers

- Gen X

- Millennials

- dental hygiene products

- oral health workforce

- diversity

- funding

- Oral Health Diversity Fund

- Delta Dental

- canines

- disease detective

- trivia quiz

- oral health trivia quiz

- oral hygiene

- oral health history

- dentures

- teeth worms

- halitosis

- 2-2-2 rule

- sensitive teeth

- herbal

- charcoal

- DIY toothpaste

- children’s toothpaste

- Women’s History Month

- female dentists

- women dentists

- pioneers in dentistry

- tooth fairy original poll

- cash gifts

- lost baby teeth

- inflation

- 25th anniversary

- photo frames

- door hangers

- in-network dentists

- network dentist

- out-of-network dentists

- contract rates

- balance billing

- dental insurance benefits

- dental ID cards

- new ID cards

- access ID cards

- digital ID cards

- virtual ID cards

- paper ID cards

- Social Security number

- denied dental claims

- in-network dentist

- out-of-network dentist

- annual maximum

- typos

- input errors

- x-rays

- basic dental insurance

- premium dental insurance

- pre-determination of benefits

- EyeMed Vision Care

- EyeMed

- dental insurance terminology

- Carryover benefits

- out-of-pocket dental expenses

- basic dental services

- major dental services

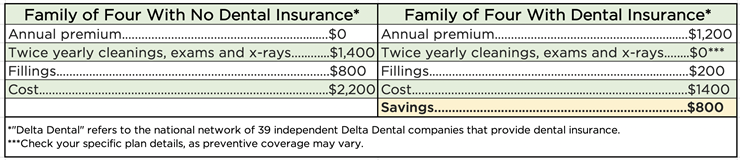

- saving money

- comparison

- saving

- agreed-upon rates

- questions

- what to ask

- choosing a carrier

- PHE unwinding

- Public Health Emergency

- Arkansas Medicaid

- Medicaid coverage

- Arkansas Department of Human Services

- DHS

- DHS office

- contact information

- Update Arkansas

- finding a dentist

- rating tool

- rating system

- scale

- scores

- quality rating

- DentaQual

- cost shifting

- cost savings

- budget

- consultant

- anniversary

- 40 years

- smiles

- largest dental insurer

- Arkansas

- Earl Gladden

- Ed Choate

- Kristin Merlo

- Best Places to Work

- dentists

- awards

- outstanding foundation

- Delta Dental of Arkansas Foundation

- community fluoridation efforts

- COVID-19 relief funding

- small business

- fringe benefits

- voluntary benefits

- mandatory benefits

- top talent

- recruitment

- compensation

- salary

- wages

- dental coverage

- group insurance

- group rates

- premiums

- tax savings

- convenience

- company culture

- flexibility

- Tooth Pain

- Pain Relief

- Dentistry

- Baby

- Benefits

- Contests

- crooked teeth

- aging

- oral health

- older adults

- medication

- recipe

- nutrition

- meal prep

- overall health

- glucose

- diabetic

- diabetes

- salmon

- dinner recipe

- nutrients

- dental plan

- dental health

- entertainment

- grants

- dental cleaning

- teeth

- seniors

- senior oral health

- Tooth be told

- baby dental health

- baby oral health

- dental care for babies

- periodontal disease

- gingivitis

- gum disease

- crafts

- tooth fairy

- enamel

- dental benefits

- dental terms

- parenting

- dreams about teeth

- teeth falling out dream

- dream about losing teeth

- annual maximum on dental plans

- understanding dental benefits

- cavity-causing bacteria

- dentist

- oral

- toothpaste

- trending

- Dental Emergency

- SEO Based

- tooth

- coverage

- Engagement

- procedure

- Vision

- snoring

- teeth grinding

- cost

- brushing

- floss

- wisdom teeth

- insurance

- Individual Insurance

- Preventive Care

- healthy mouth while camping

- dental costs

- halloween

- trick-or-treat

- children

- candy

- during a pandemic

- COVID-19

- caramel

- chewy

- water

- fluoride toothpaste

- plaque

- crown

- root canal

- ice cubes

- hard candy

- flossing

- gums

- nuts

- cracking

- biting

- chewing

- Christmas

- Holidays

- low deductible

- affordable cost

- parents’ coverage

- losing eligibility

- turning 26

- individual vision insurance

- individual dental insurance

- vision insurance

- dental insurance

- Post-Millenials

- Gen Z

- Delta Dental of Arkansas

- SuperiorVision

- eye pigment

- melanin

- free radicals

- macular degeneration

- cataracts

- eye diseases

- zeaxanthin

- lutein

- citrus fruit

- oranges

- folic acid

- zinc

- Vitamin E

- Vitamin C

- calcium

- nutrients for healthy teeth and eyes

- diet

- water filters

- bottled water

- fluoride liquids

- fluoride tablets

- fluoride foam

- fluoride gel

- tooth decay

- fluoride treatment

- dental insurance plan

- cavity-fighter

- cavities

- cavity

- CWF

- community water fluoridation

- water fluoridation

- fluoride

- network

- affordable premiums

- negotiated rates

- agree-upon rates

- wrong question

- out-of-pocket expenses

- maximum insurance benefits

- insurance benefits

- in-network provider

- network provider

- dental treatments

- expenses

- smile

- George Washington’s dentures

- bad teeth

- George Washington

- sealants

- permanent teeth

- primary teeth

- molars

- premolars

- Bicuspids

- loose tooth

- Glitterville

- glitter dresses

- celebration

- yanking

- pillow

- baby teeth

- loose baby teeth

- infographic

- baby tooth

- Tooth Fairy wand

- Tooth Fairy crown

- Tooth Fairy costume

- Tooth Fairy wings

- letters to the Tooth Fairy

- Tooth Fairy crafts

- tooth bottle

- video

- treasure

- garden

- castle

- loose teeth

- Ratoncito Pérez

- Tooth Rat

- Elf and Brownie

- Magical Mouse

- appearance

- grinding

- anxiety

- nightmares

- Teeth falling out

- berries

- leaves

- odont

- Delta

- Omicron

- god of medicine and healing

- Asclepius

- purple

- lilac

- snake

- dentistry symbol

- vision coverage

- AOA

- AAO

- blinking

- blurred vision

- gritty eyes

- dry eyes

- eye discomfort

- digital eye strain

- screen time

- digital device

- light spectrum

- visible light

- eye damage

- UV light

- blue light

- e-book

- lubricating eye drops

- artificial tears

- washcloth

- gel eye mask

- compresses

- warm and cold eye

- screen glare

- overhead lighting

- optometrist

- eye doctor

- eye care provider

- eye exam

- developing good oral health habits

- treats

- kids

- fun activities

- tooth enamel

- seeing a dentist

- brushing teeth

- sugar swaps

- sugary foods and drinks

- oral injuries

- athletics

- sports

- mouthguards

- sugary drinks

- alternatives

- sweets scale

- holiday candy

- sugary holiday treats

- disease detection

- diseases

- save your life

- dental exam

- myokymia

- vision loss

- glaucoma

- eye infections

- eye twitches

- eye spasms

- light sensitivity

- itchy eyes

- eye health

- sleep

- red spots

- white spots

- sulfur

- bad breath

- bacteria

- brushing your tongue

- tongue

- Superior Vision

- premium plan

- standard plan

- copays

- eyeglasses

- frames

- contact lenses

- eyeglass lenses

- eye exams

- vision plan

- soft bristles

- firm bristles

- scrubbing

- saliva

- rinsing with water

- amounts

- toothbrush

- brushing teeth mistakes

- cataplexy

- muscle weakness

- muscle loss

- sleepiness

- double vision

- twitchy eyelids

- droopy eyelids

- narcolepsy

- healthy treats

- sweet tooth

- hydration

- watermelon

- mouthwash

- heart disease

- routine

- habit

- window to overall health

- tartar

- professional dental cleanings

- recipes

- taco bar

- salsa

- mango margaritas

- tacotuesday

- tacos

- eye irritation

- eyestrain

- employee benefits

- sugar-free gum

- electric toothbrushes

- camping

- employer plans

- handshake

- smelly skin

- smelly clothes

- nicotine breath

- yellow teeth

- yellow nails

- business owner

- entrepreneur

- investors

- bad first impression

- general and oral health

- cool

- stress

- smoking

- behavioral issues

- learning disabilities

- eye-hand coordination

- clumsiness

- squinting

- white pupil

- lazy eye

- crossed eyes

- vision issues in children

- phosphates

- remineralization

- acids

- pH level

- snacks

- toothbrush holder

- mold

- yeast

- salmonella

- E. coli

- Coliform

- germs

- white teeth diet

- coffee

- poor oral health habits

- genetics

- pregnancy gingivitis

- menstruation gingivitis

- hormonal fluctuations

- progesterone

- estrogen

- female hormones

- check-in procedures

- safety protocol

- risk

- pandemic

- dentist visits

- citrus

- sodas

- acidic foods

- starchy foods

- sticky foods

- polyphenols

- antioxidants

- teeth staining

- raspberries

- blueberries

- strawberries

- low birth weight

- premature birth

- prostaglandin

- vomiting

- food cravings

- gestational gingivities

- pregnancy

- infused water

- cucumber

- summer drinks

- sugar-free drinks

- party drinks

- missing school

- peace of mind

- childrens oral health

- back to school

- dental check-up

- dental visits

- dental appointments

- oral care

- healthy living

- vitamins

- fiber

- whole wheat

- broccoli-egg-cheese muffin

- banana muffins

- blueberry muffins

- muffins

- chronic childhood disease

- academic performance

- school absences

- sugar substitute

- stevia

- xylitol

- milk

- smoothies

- eggs

- protein

- dairy

- fruit

- morning routine

- snacking

- fruit juice

- drinking milk

- sugar intake

- refined starches

- refined sugars

- breakfast alternatives

- cereal

- sugary cereals

- spices

- herbs

- healthy oils

- fluid

- grains

- vegetables

- fruits

- books for kids

- cavity prevention

- relaxation techniques

- dental staff

- positive associations

- positive attitudes

- dental chair

- regular appointments

- fear of dentist

- dental anxiety

- positive reinforcement

- healthy habits

- education

- fluorosis

- teeth crowding

- thumb sucking

- regular checkups

- child development

- specialist

- dental anxiety specialized training

- special-needs children

- general dentist

- pediatric dentist

- inclusion

- non-edible

- sugar

- food allergies

- teal pumpkin project

- teal pumpkin

- stress management

- tooth sensitivity

- receding gum lines

- toothache

- broken teeth

- pain

- sore jaws

- headaches

- bruxism

- teeth clenching

- tube

- pumice

- whitening

- chalk

- burnt bread

- brussels sprouts

- sweet potatoes

- fat

- salt

- healthy side dishes

- Thanksgiving

- periodontitis

- fungi

- fungus

- probiotics

- microbes

- harmful bacteria

- healthy bacteria

- Bifidobacterium

- Lactobacillus

- tempeh

- miso

- kombucha

- sauerkraut

- kimchi

- kefir

- yogurt

- probiotic supplements

- fermented foods

- friendly bacteria

- green tea

- black tea

- soda

- trapped

- worst foods for teeth

- best foods for teeth

- egg cookers

- drinking straws

- chocolate

- gum

- toothbrush cases

- toothbrushes

- water bottles

- smile-friendly

- stocking stuffers

- mature tooth

- anesthetics

- infection

- pulp

- pulpal damage

- endodontist

- endodontics

- biometrics

- most updated security technology

- new technology platform

- enhanced functionality

- December 2021

- November 2021

- relaunch

- Delta Dental mobile app

- checkup

- preventive care visit

- professional cleaning

- slow month

- September

- dentist’s appointment

- dentin

- minerals

- acid reflux

- fish scales

- bone

- hardest substance

- high blood pressure

- blindness

- inflamed gums

- tooth loss

- fluid buildup

- POAG

- optical nerve

- K-4

- elementary school students

- markers

- crayons

- art supplies

- science experiment

- classroom projects

- marshmallows

- healthy eating

- sad tooth

- happy tooth

- lesson plans

- in-network

- insurance coverage

- major services

- retainer

- braces

- maxillofacial surgeon

- oral surgeon

- orthodontist

- periodontist

- Dental specialists

- liquid form

- layer

- film

- glass ionomer

- quick

- painless

- pits

- grooves

- barrier

- arthritis

- carpal tunnel

- replacement

- timers

- rotation

- vibrations

- safe

- effective

- plaque removal

- manual toothbrush

- power toothbrush

- powered toothbrush

- electric toothbrush

- immune system

- dry mouth

- lost teeth

- oral cancer

- stained teeth

- snuff

- chewing tobacco

- cigars

- cigarettes

- tobacco

- nicotine

- healthy meals

- Arkansas State Parks

- hiking

- summer camps

- summer activities

- obesity

- physical activities

- childrens health

- mouth guard

- adolescents

- inflammation

- restricted blood flow

- aerosol

- vaping

- e-cigarettes

- recreational use

- medicinal use

- lesions

- HPV

- tooth discoloration

- joint

- pot

- weed

- cannabis

- Marijuana

- sugar cravings

- stains

- chronic alcohol consumption

- heavy drinking

- cocktails

- alcohol

- spirits

- wine

- beer

- jaw clenching

- addiction

- drug abuse

- meth mouth

- ecstasy

- opioids

- methamphetamine

- meth

- cocaine

- Heroin

{{ showingText }} {{ showingTagName }}

There are not results to show